Credit Score Calculation For Your Business!

Search for a credit score to enable loan, mortgage, and line of credit application approval. Look only at credit ratings. We compute your credit score precisely and affect your eligibility to be accepted.

A credit score is a crucial component of your credit rating and can significantly affect your interest rates paid as well as your debt load. These are some main elements influencing Credit Utilization: Credit use history, payments, and other considerations.

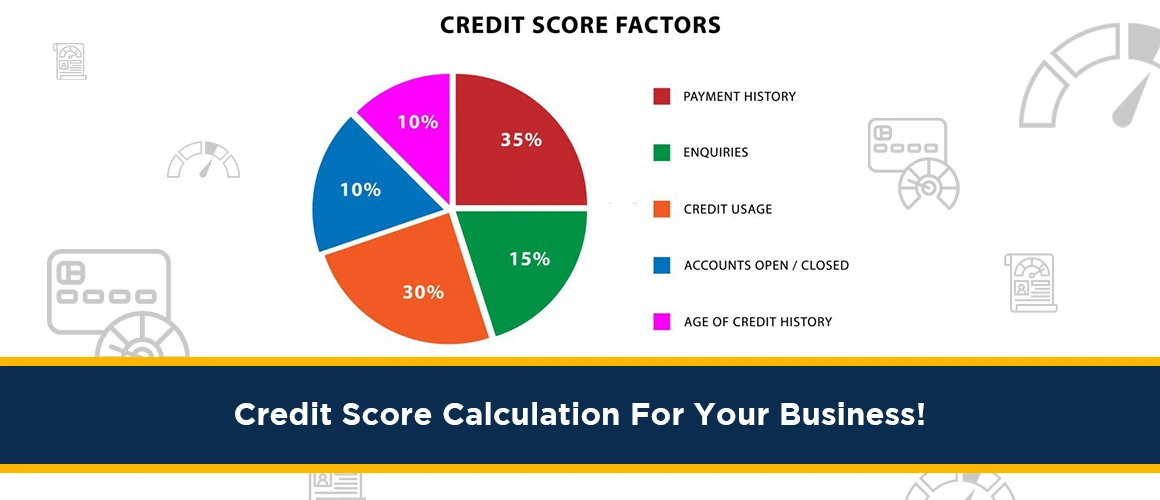

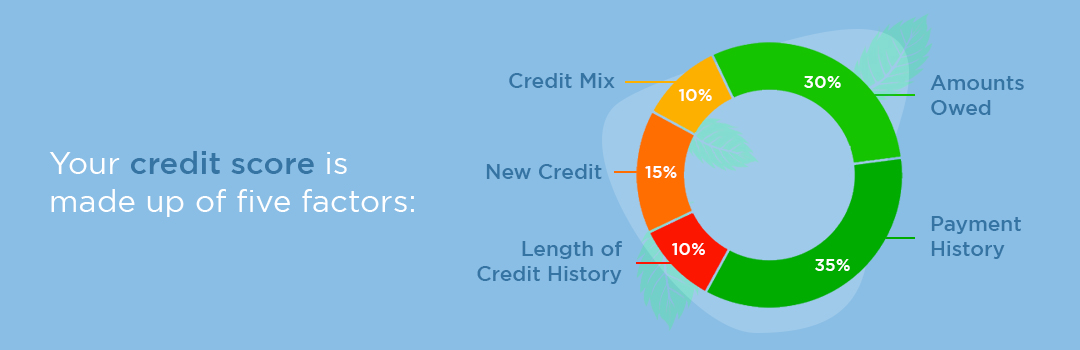

What Matters In Your Credit Score?

Trying to raise your credit score? See our free credit report offerings here. We compile information on your credit score, payment timeliness, credit history length, and more. We also will suggest goods and services that might raise your credit score. Use our free, simple credit score calculator to figure your credit score. See how your credit is going using our tool; then, identify which sources are most accurate.

Obtain FICO's free credit score. See your credit score using our FICO credit scoring algorithm and see whether your credit rating requires work.

- Payment History: Regularity of timely payments.

- Total Amounts Owed: On every line of credit, including

- Credit History Length: The duration of opening of an account

- New Credit: The count of recently created credit accounts.

- Credit Mix: Lines of credit mixed with continuous loan borrowing.

1. Payment History

Looking to stay in decent financial shape? Success comes mostly from your payment history. Knowing what payments you have made helps lenders evaluate your creditworthiness and weigh providing you money. This is a major determinant of your capacity to pay back debts and shapes almost half of the FICO scoring algorithm.

2. Amounts Owed

The total of all open lines of credit and loans how much of your available credit you have spent—is known as amounts due. Lenders have great concern about a heavy debt load. This explains thirty percent of your FICO result.

3. Length of Credit History

Wanting to raise your credit score Look no further than our article on length of credit history! This data will construct your credit foundation and assist you in ascertaining how long you have held credit.

4. New Credit

See how your score compares to other lenders and find out how much fresh credit your area is opening. With the most recent information on all the best credit card and loan offers, credit repair

5. Credit Mix

The mixture of several open accounts—loans, credit cards, and other forms of credit—is known as a credit mix. Using several open lines of credit diversifies your credit record and demonstrates to creditors your ability to properly handle several financial accounts.

What’s the Difference Between FICO and VantageScore?

Trying to raise your credit score? Examining six elements to establish your credit score, the VantageScore algorithm differs somewhat from the FICO Score. It also adds one other element, available credit, which reveals your line of credit usage level.

Look only at FICO or VantageScore if you want a precise credit score. Considered industry standards are both of these calculators.

Negative Factors That Impact Your Credit Score

Seeking a better credit score? See our offerings to assist in your recovery after a setback. To help you grasp and resolve any bad elements influencing your credit score, and enhance your future opportunities. Get in touch now to find out more.

Late or Missed Payments

Check Your Credit Score to find out whether you are paying your bills on schedule. Should it go below a particular level, late or missed payments could compromise your credit.

Accounts In Collections

When you have delinquent payments, send your accounts to collectors; stay on a credit report for up to seven years!

Bankruptcy

Should you file for Chapter 7 or Chapter 13 bankruptcy, your debts could remain on your credit report for up to ten years.

Should you have debt, Chapter 13 bankruptcy is the ideal fix. Your assets will be utilized to pay off other debt; you will pay off the debt on a scheduled basis. This will enable you to resume your life and protect your family.

Account Charge-Offs

Should you have an overdue account, our staff can assist in the collection of it. Your account will be written off as a financial loss and kicked off from your credit report for up to seven years using our charge-off service.

Maxed Out Credit Cards

Although maxing out your credit cards will raise your credit score, always spend the entire allowed amount on a credit card. Should you surpass your credit limit, you risk losing your score and being closed out of some possible financial prospects.

Closed Credit Cards

Seeking means to raise your credit score? Review our past credit records! Closing an account removes this information from your credit record, which lowers your credit limit and can result in a credit score loss.

Multiple New Credit Applications

Monitoring your credit score is crucial if you want to secure fresh lines of credit. These questions could temporarily drop your score, hence you should be informed of possible outcomes.

Looking to borrow money? For creditors, mortgage lenders, and banks, this can create cause for concern. They presume you have high credit risk, hence you run an increased chance of being denied a loan.

Home Foreclosure and Loan Defaults

Seeking a strategy to pay off your loan? When a house owner misses loan payments, foreclosures and defaults follow. Often sold to cover delayed payments, banks, and creditors can grab assets. On a credit report, foreclosures and defaults remain for up to seven years.

Search for a loan free of negative impact on your credit score. You just need to look at our subprime debtors! You should relax knowing that you will be able to obtain a loan without any difficulty since they are the riskiest borrowers and are unlikely to pay back their loans.

How to Improve Your Credit Score?

Use this guide to Improve Your Credit Score to a suitable level. You'll pick up skills in creating a financial plan, keeping on target, and raising your credit score.

Here are five tips to help you start improving your credit score.

1. Download a free copy of your Annual Credit Report

Searching for mistakes or indicators of fraud and trying to raise your credit score? Look no further than our free credit report review service! We will go over your credit report to provide you with the most current information on any issues or mistakes.

2. Dispute credit report errors

Repair your credit report without visiting a credit counseling agency. Analyze and fix your credit report for mistakes right now!

3. Seek help from a credit counselor or credit repair company

Want your credit score raised? Look not much beyond our Credit Repair Company. We can assist you to find credit mistakes and create a financial plan meant to raise your credit score. Get in touch now to have a free consultation!

4. Pay off accounts in collections

Clearing accounts in collections will assist stop unfavorable reporting.

5. Inquire about financial hardship programs

Searching for a means of covering your pandemic expenses? American Express runs a Financial Hardship Program. Those most in need of credit cards and small loans can find them offered under this scheme.

Seeking means to raise your credit score? View our complimentary credit report right now. Get your score in less than sixty minutes and learn how to better shape your financial destiny. Understanding all the elements influencing your credit score can help you to raise it. For individualized advice, either visit a Credit Repair Specialist or search for free materials online.

To obtain the best credit repair services right now, call (888) 804-0104!