Do You Have To File A Dispute With All Three Credit Bureaus?

When Disputing Credit Report Entries, Do You Need To Record A Dispute With All The Three Credit Reference Agencies?

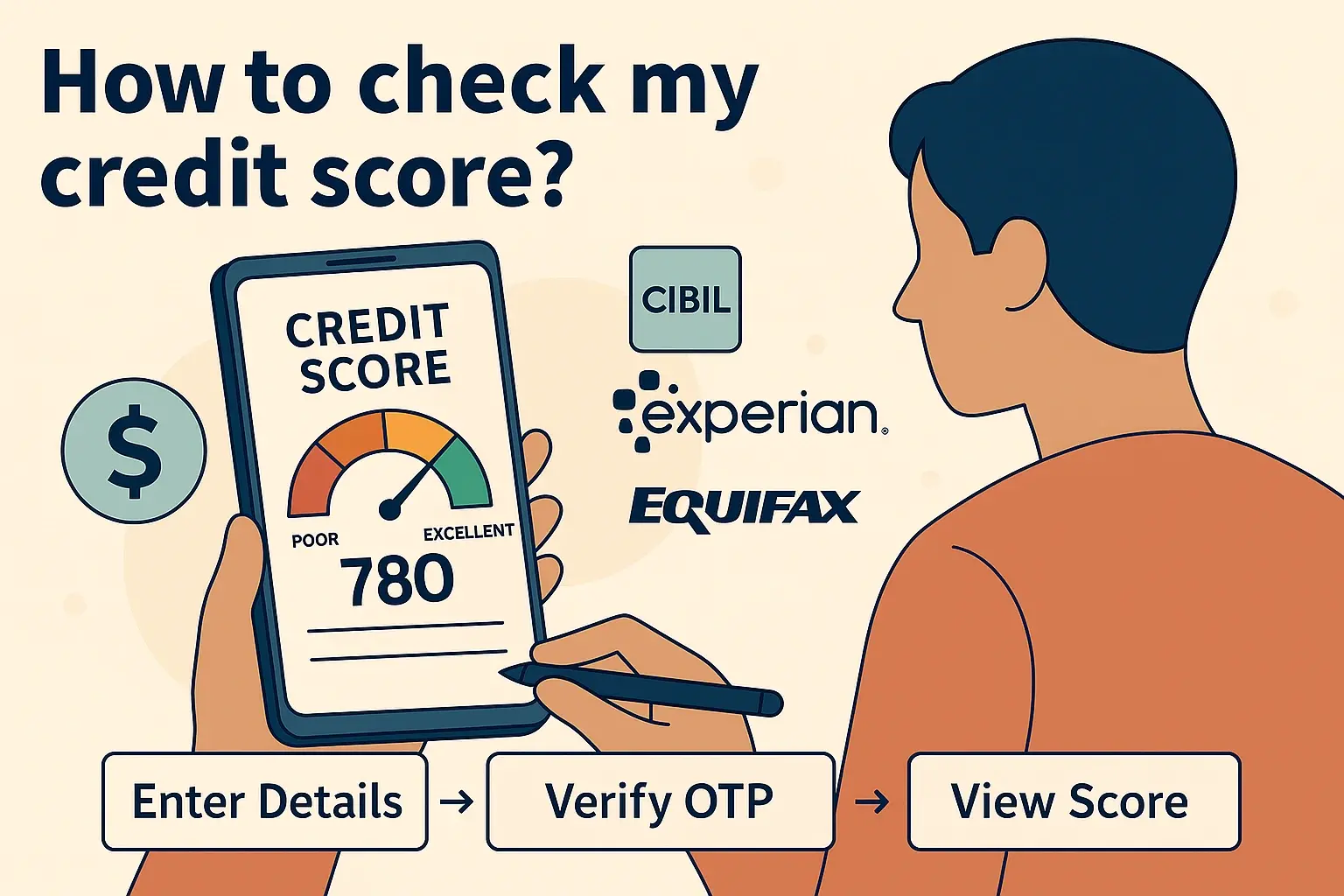

In your financial life, your choice is much influenced by your credit record. When choosing whether to give money to you, rent their property to you, or offer you employment, among other things, bankers, property owners, insurance companies, and sometimes even employers do credit searches on you. Nonetheless, errors are inevitable from time to time, and sometimes erroneous information may make its way into your credit records via the three main national credit reference agencies: Equifax, Experian, and TransUnion. Should you find a mistake on your credit report, you have the right to dispute it with the credit bureau or agencies. But do you have to submit the issue with one or two or all three bureaus?

Importance of Disputing Errors

Disputing and correcting errors on your credit reports is critical for several reasons.

- Higher credit scores. Late payments or collections accounts that are not yours can pull down your credit scores in a wrong way if you are fed with negative information that is not true. Erasing mistakes can improve your scores. A higher number on the credit score scale opens doors to a favorable loan package and better interest rates.

- Improve approval odds. Errors in your reports can lead lenders to reject your applications for credit or any other product that they offer. Addressing mistakes increases your likelihood of getting approval.

- Eliminate identity theft problems. If there are accounts that have been fraudulently opened in your name, it is important to dispute this information so that further cases of ID theft can be prevented.

- Ensure report accuracy. You have rights under the Fair Credit Reporting Act that entitle you to accurate reports. This right is how one challenges errors and ignites them into existence.

You may encounter some of the same mistakes on the Equifax, Experian, and TransUnion reports or have different mistakes on each of the reports. That leads to the next question: Do you report to one bureau some of them or all three bureaus every time you find an error?

Disputing With One Bureau

Disputing with one of your credit bureaus may alone be sufficient to rectify the error in question. Under the FCRA, when you send a dispute to one bureau, that agency is obligated to verify by contacting the lender/debt collector who supplied the information. If the bureau concludes your dispute is valid and the negative mark is incorrect.

- The bureau that investigated must promptly correct or remove the inaccurate information from your report. This should increase your credit status with them if it has affected the numbers.

- They also must inform the other two bureaus of the need to correct that item, which should result in its removal from the other two reports as well.

The main benefit of only disputing with one bureau is simplicity, but there are downsides to this approach.

- The other two bureaus may not even update your file even if they are notified of inaccuracies present in it.

- Still, various bureaus may respond to the disputes and the effectiveness of managing the disputes in different ways. It may remain zero for a long time while others can repair it within a short period.

Due to such discrepancies, it is sometimes more advisable to challenge directly with multiple bureaus to ensure the negative information gets investigated and reported across all your reports.

Disputing With Two Bureaus

It is up to you to decide whether to report your dispute to two of the three major credit bureaus. Perhaps you have errors on only two reports, or you wish to file a dispute with two to stand a better chance of getting mistakes eradicated in all the reports. Notify two bureaus that you have disputes to help prevent future problems, but it may not stop the third agency from reporting your information incorrectly.

Challenging all three credit bureaus at the same time offers the best guarantee that all of your credit reports are updated and fixed, if necessary.

Pleading With All Three Bureaus

To investigate negative information and guarantee that your credit data is fully accurate, most consumer advocates suggest that you should dispute errors with Equifax, Experian, and TransUnion simultaneously. While it takes more effort upfront, simultaneously contacting all three has important benefits.

- Your dispute will be addressed individually to each bureau, and you will not have to wait for them to exchange information. This starts investigations faster.

- It avoids cases where one bureau gives you an update on your credit status while the other is not informed of the inaccuracies by the first bureau.

- The three credit files get updated immediately in cases where concurrent disputes are deemed to be valid. This is probably the most effective way to achieve the maximum score increase across all your reports.

- When you have identity theft accounts opened in your name with multiple burpees, simultaneous disputes are ideal if further damages are to be stopped.

Learn About the Dispute Filing Process With All The Three

It is quite easy to file a dispute with one credit bureau. It is a little bit more work to do all three at the same time, but that way, you get a full and fast response. Here are some ways to get your dispute filed efficiently with Equifax, Experian, and TransUnion concurrently.

Dispute online. All the websites of the three bureaus have an online dispute fill-and-submit form through which you can file a dispute online on each site.

Dispute by mail. The forms and letters that you can download from each credit bureau to complete include dispute forms. Write and send letters to each agency’s dispute address. Photocopy the supporting documents, such as proof of identity or payment, to enclose with each mailed dispute package.

Try dispute software. Dispute software enables you to key in your dispute particulars once, and the system will complete and transmit personalized dispute letters coupled with other e-docs such as scanned IDs or proof of payments to all agencies on your behalf. This ensures any completed disputes are sent to all relevant bureaus as and when they are completed accurately.

Certainly, filing credit disputes with all three credit bureaus is slightly more work than filing a dispute with only one bureau. But it ensures that negative errors are investigated to the fullest and completely eradicated across your credit file with Equifax, Experian, and TransUnion. Spending a few more minutes to file concurrent disputes is time well spent arguing with bureaus later on failed updates and provides the highest credit score boost!

Ready to boost your credit score? Call +1 888-804-0104 now for the best credit repair services near you! Our expert team is here to help you achieve financial freedom and improve your credit. Don't wait—get started today!