Does Asking For Increase In Credit Affect Score?

How Does Requesting an Increase in Credit Limit Affect Your Credit Score?

People's financial life revolves much around their credit scores. It establishes the credit products—loans and credit cards—for which you qualify, as well as the interest rates charged. You would thus be naturally concerned not to do anything that would reduce it. However, one should consider whether it is suitable to ask for a larger credit line. Will this harm your credit?

Simply said, requesting a larger credit limit has no negative effect on your credit score. Thus, receiving more credit is not likely to lower your credit score if you are cautious about the extra line of credit you are requesting. For some time, nevertheless, your score will be somewhat lower if the credit card company reviews your credit report in order to evaluate your application for a greater credit limit.

This is how credit inquiries impact your credit score

Every time you apply for a new credit card, an auto loan, or a mortgage, among other things, the credit reporting company will run your credit report to determine your creditworthiness. This is also referred to as a credit inquiry. There are two types of credit inquiries.

- Reviewing your credit record or having a lender examine your credit report to qualify you for their credit offers results in soft inquiries. Generally speaking, mild queries do not affect your credit score.

- As you seek credit, you make hard queries. Many hard queries within a short period will somewhat reduce your credit score and indicate to potential lenders that you represent a high credit risk.

The effect of hard inquiries will vary depending on your credit picture and credit score. If you have a long credit history and a good score, then a new credit check will not do much harm. But, if you have a low credit limit and low credit score and if your credit report is thin, new hard inquiries are likely to adversely affect your score more.

Typically, one new hard credit inquiry can only lower your credit score by a few points, but this depends on other factors. The impact of it also does not generally last for long as hard inquiries have lesser influence after 12 months and are deducted from your credit reports after 2 years.

Does an Application for a Higher Credit Limit result in a Hard Inquiry?

In most circumstances, applying for a higher credit card limit does NOT trigger a hard pull on your credit reports. In most cases, credit card companies don’t check your credit score when considering an application for an increase in the credit limit on an existing credit card.

However, they will typically make the decision based on the payment and balance details they already possess concerning your account with them. As far as credit cards are concerned, anyone with a clean slate and a decent payment record, a balanced credit limit versus credit usage, and so on, has a good chance of getting approval.

As such, requesting an increase in the credit limit on the existing credit card does not affect the credit score in the process. This makes requesting credit lines a wise and risk-free approach to increasing your total amount of credit.

The reasons why increasing your credit limit may be beneficial to your credit scores.

Although requesting an increase in the credit limit can help you acquire a higher limit without enhancing your credit scores, using the credit limit responsibly helps to boost the scores. Here’s how it works to your benefit.

Lower Credit Utilization Ratio

Credit utilization is the second most important component affecting the FICO credit score after the payment history. This measure looks into the total credit card balances that you have and divides them by the total credit limits you have.

It is wise to ensure that credit utilization has not crossed 30%, as advised by experts. Therefore, when one’s credit limit is increased while the balances remain constant, one’s utilization ratio is reduced. This can help increase your credit score, particularly if you are reaching your utilization rate, which is near the limit of your credit limit.

For instance, you may have a combined card limit of $ 20,000 and average daily balances of $ 5,000 across all your cards; then your utilization rate will be 25%. However, if, for instance, you are approved to increase one card’s limit by $5,000, making your total limits equal to $25,000, while your balances remain the same, your utilization ratio is now 20%. This lower percentage will help your credit scores.

Build a Longer Positive Payment History

The longer accounts with no problems remain open, the longer they reflect a good record for credit score. Maintaining credit cards that are inactive after receiving an increase in credit limit helps one to establish a longer credit history than creating new accounts.

SHOULD ONE CARRY OVER A BALANCE FOR CREDIT? One of the credit myths that people like to believe is that you have to maintain a balance on your credit card or cards to have an excellent credit score. That is completely false! Carrying a balance means that you are charged interest fees on the balance amount each month. That does nothing beneficial for your credit.

They argue that it is possible to maintain good credit responsibly by keeping the cards active, charging normal purchases, and making timely and full payments every month. They shouldn’t be paying interest fees that they do not have to.

When a credit limit increase request may lead to a hard pull

It’s rare, but some credit card issuers may pull your credit report when you request a higher limit, as in the case of American Express and Discover. With those card providers, an application for additional credit could be seen as a hard inquiry and lead to a slight and temporary reduction in your credit score.

You can always talk to their customer service departments and inquire if they perform hard credit pulls when approving requests to increase credit lines on existing accounts. That way, you’ll know what to expect.

The Disadvantages of Having Too Much Credit Facility Available

Aside from the impact credit inquiries may have, dramatically increasing your available borrowing limit also has potential downsides.

- Going Overboard on Debt: Even if you have more access to credit, this does not mean that you should go and use it! It is also important that you have a clear budget and spending plan so that you just borrow what you can repay each month.

- Higher Potential Fraud: If your information got into the wrong hands, more open credit means that the unauthorized charges could cause further damages before you notice any unauthorized account activity.

- Usage Variations Matter More: Overspending on a card with a credit limit of $100 is viewed differently from overspending on a card with a credit limit of $ 100,000. As high-limit cards may have higher minimum payments, fluctuations in large balances may be more challenging.

In most cases, approval for more credit does not necessarily have a bad impact on credit scores However, it is important not to request for credit limits to be increased if this is not necessary or if one cannot afford to keep up with the costs.

Guidelines You Need to Consider When Asking for Credit Line Boost

If having a higher limit on your credit card aligns with your financial goals, here are some tips to boost your chances for approval and avoid credit score impacts.

- Wait for at Least 6 Months: Pay your balance in full and on time every month before requesting an increase in your credit limit. Avoid requesting frequent increases.

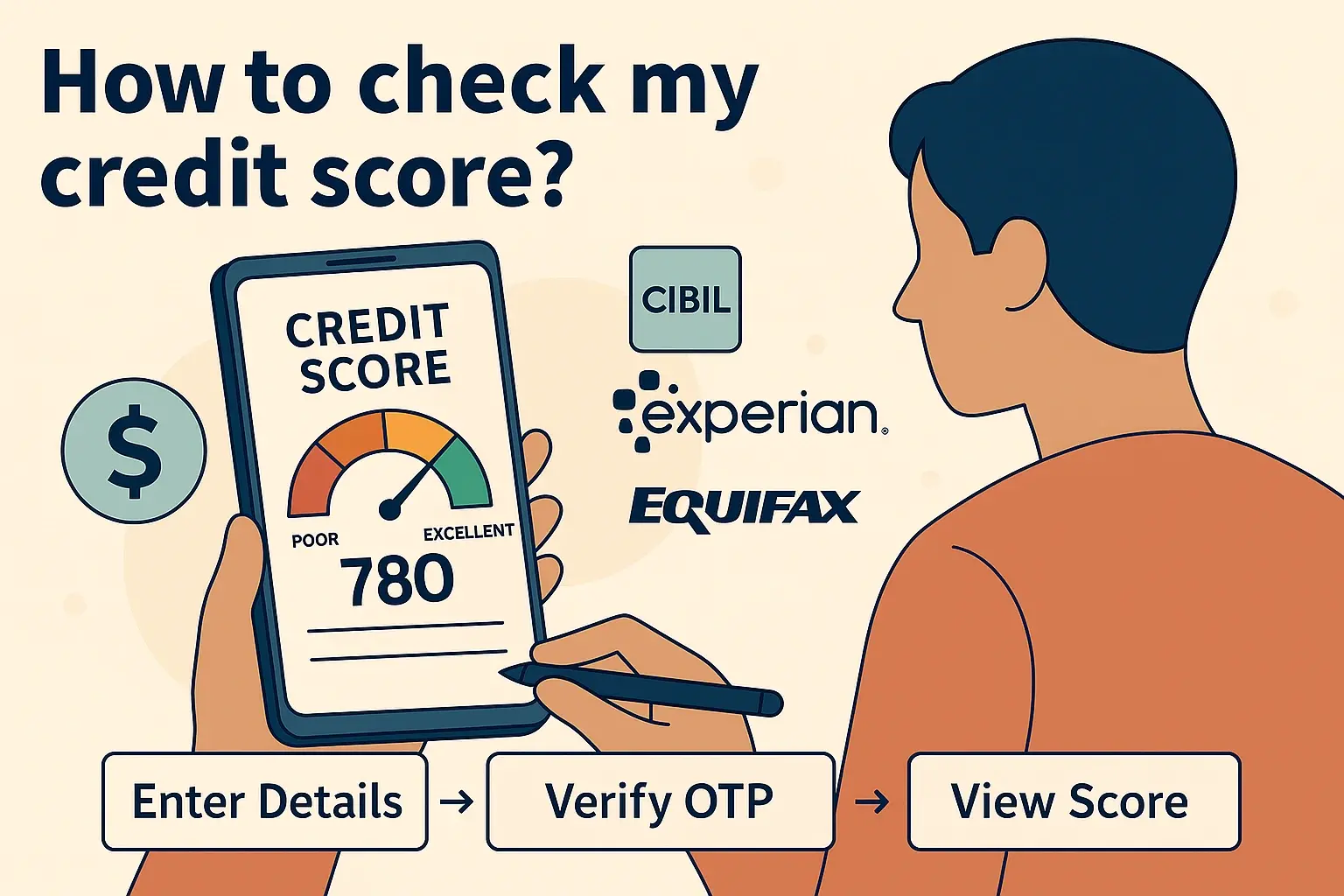

- Check Your Credit First: Check your credit reports and FICO or Vantage credit scores so you can determine your credit status before making a request.

- Pay Down Current Balances: Maintaining high balances against your limit is indicative of credit risks. It is recommended that you use your pay cards to below thirty percent of their limit before requesting more.

- Ask for A “Soft” Review: Be specific and request that the increase review be done without a hard inquiry on your credit file. Ensure it does not affect it in any manner to avoid getting into more complications with my credit score.

- Consider Alternatives: If your issuer declines or demands a hard pull, apply for the other card with a greater limit and an introductory zero percent interest rate offer to avoid the hard credit check on the other accounts.

Check out the pros and cons.

A higher credit limit could be useful in maintaining low credit utilization and further building on a high credit score over time. However, exercise some measure of caution when applying for more available credit on existing credit cards or when applying for credit cards, loans, or other credits that you do not stand a reasonable chance of being able to repay.

Ready to boost your credit score? Call +1 888-804-0104 now for the best credit repair services near you! Our expert team is here to help you achieve financial freedom and improve your credit. Don't wait—get started today!