Does Pre Approval Affect Credit Score?

How Does Pre-Approval Impact Credit Score?

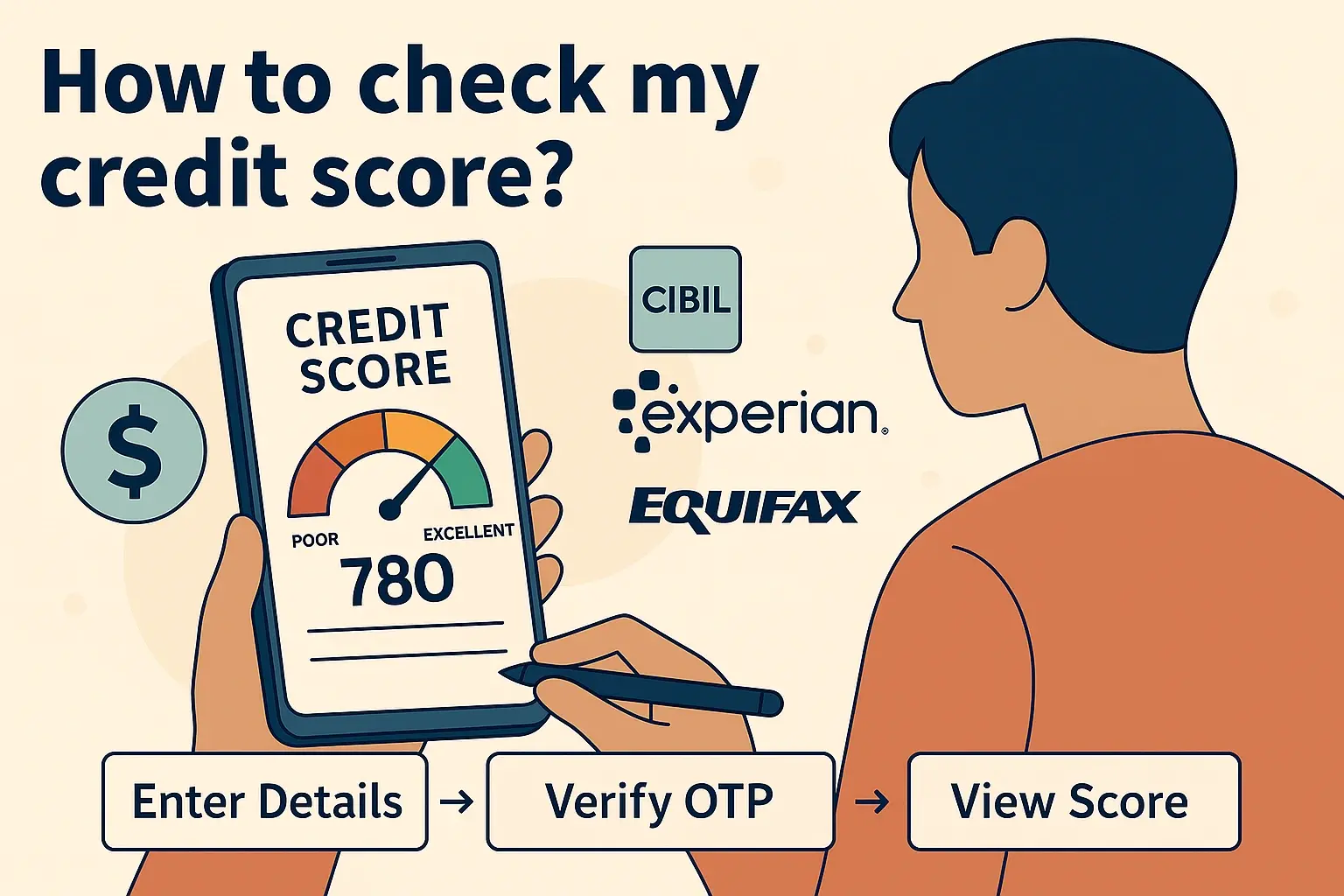

When you are looking for a mortgage, auto loan, or any credit card, you are likely to stumble across advertisements that state it is pre-approved only for you. These pre-approval offers inform you that you will be approved if you apply for a particular loan. As getting these kinds of offers involves the lender pulling your credit, a frequently asked question is Does pre-approval affect your credit?

To answer the question briefly, no even if you are pre-approved for a loan or credit card, your score will not decrease. But there are some things that you need to know about the pre-approval process and when it may involve soft credit pull as opposed to hard credit check.

What is Pre-Approval?

Prescreening is when a credit provider assesses your creditworthiness to see if you qualify for one of its loan products or credit cards without formally applying. Depending on your credit history and other parameters, the lender will provide a pre-approval letter to inform you that you are probably going to get approved if you apply.

It does not mean that the loan will be approved, but it will tell you in advance that you qualify for a loan based on the general criteria. This makes it easier to compare different lenders and the times interest rates and other terms as one can be certain that their credit will not be rejected.

Soft Inquiry Vs Hard Inquiry

Soft credit checks and hard credit checks are the two main credit checks that exist in the market. The difference between the two relates to how they impact your credit score.

Soft Check This is a non-adverse check of your credit report to filter through the offers. On the same note, soft inquiries also have no impact on the credit score of the consumer in question. Hard pull This is when a credit reference agency reports your credit file when you make a credit application. While hard inquiries do not have a significant impact on credit scores, there can be a slight decrease in the score for some time.

Most pre-approvals involve soft inquiries; hence, pre-approvals are considered. This means that the pre-approval process enables the lenders to assess your profile without affecting your score. Occasionally, a lender might perform a hard check for pre-approval, though this is less frequent. They are more serious than a mere pre-screen, where a creditor checks to see if you are a good candidate for an offer of credit.

How Pre-Approval Works and Why It May Check Your Credit?

A large number of banks and other lenders buy lists containing several consumer records to identify who they should send a direct mail flier that says You have been pre-selected and pre-approved. This type of pre-approval pre-screen is very common and does not require the lender to pull your credit report at all.

However, some lenders take it a notch higher by conducting a soft credit check before sending a pre-approval mail. This enables them to screen potential applicants a bit more narrowly by actually ensuring that you have good credit standing as per the report.

For instance, an auto dealership may use a credit screening tool to check your credibility before informing you that you have been pre-approved to finance the purchase of a car. A mortgage lender may also run a credit report to see if you meet their pre-approval conditions.

In these cases where a soft inquiry is done, the credit check normally does not affect your credit score. If you are not submitting a full application that demands a hard credit check to verify your income, employment, assets, etc., then pre-approval is typically a soft credit check.

When do You Apply for Actual Credit?

If you're just ascertaining that you qualify for a pre-qualification, you don't harm anyone, but when you fill out a formal application, it will harm your credit report. The process involves submitting all documents needed to be granted a loan, and other details relating to the same. However, credit checks do pull your credit score slightly down for a few days if it is a hard credit check.

Thus, the extent to which applying hurts your score depends on the number and frequency of applications and other factors. An individual with a good credit score and one or two inquiries will observe very little effect. If you have a poor credit history or if you are applying for credit, the hard inquiries add up and impact your credit rating more.

General Consequences of Hard Credit Check

Here is the general range someone might expect their credit score to go down after applying for credit.

One Hard Inquiry may lower the score by 0 to 5 points. Two to Three Hard Inquiries May lower the score by 5 to 15 points. Four or More Inquiries May lower the score by 15 to 25 points.

This dip only lasts for 12 months from the date of the inquiry and this is a restriction of the system. In the last year, the inquiry no longer counts towards the total score. If approved, the number of new accounts also reduces the average account age; although with a comparatively smaller impact, it would lower the score slightly.

Don't Be Fooled: Pre-Approval Does Not Commit You to Buying a Home

A major benefit of pre-approval is that it will involve no commitment to any specific financing plan. Still, being pre-approved does not entail filling out the application and taking the loan in the future. You can go out shopping with a clear mind and at the end of the day, conclude that another option is more suitable.

The pre-approval does not put you under any obligation to accept the credit offer if you do not move to the next step of applying, credit document verification, and approval. That means that there are no risks in checking there might only be some advantages in knowing whether you qualify or not.

Weighing Potential Credit Impacts

It is rather important not to focus exclusively on the score that the new credit lines will have on you. Although it is beneficial to avoid hard inquiries whenever possible, expanding access to competitive loan offers, fair interest rates, and favorable terms that can translate into more significant savings, in the long run, is useful as well.

Often, even small credit score decreases are worth it when considering the improvement in loan terms. Therefore, do not allow the fear of inquiries alone to bar you from venturing into a new business. Assess any pre-approvals as strategies for gaining the right financing and track your credit report and score movement.

It is possible to be watchful of your approval chances as well as carefully apply and open new credit to get the best of both worlds in the long run.

Ready to boost your credit score? Call +1 888-804-0104 now for the best credit repair services near you! Our expert team is here to help you achieve financial freedom and improve your credit. Don't wait—get started today!