How Bad Does A Repo Hurt Your Credit?

If one fails to honor the car financing agreement, the credit score is likely to drop, and it becomes quite difficult to get credit facilities in the future. A repossessed car is one of the worst items you can see when you are checking your credit report.

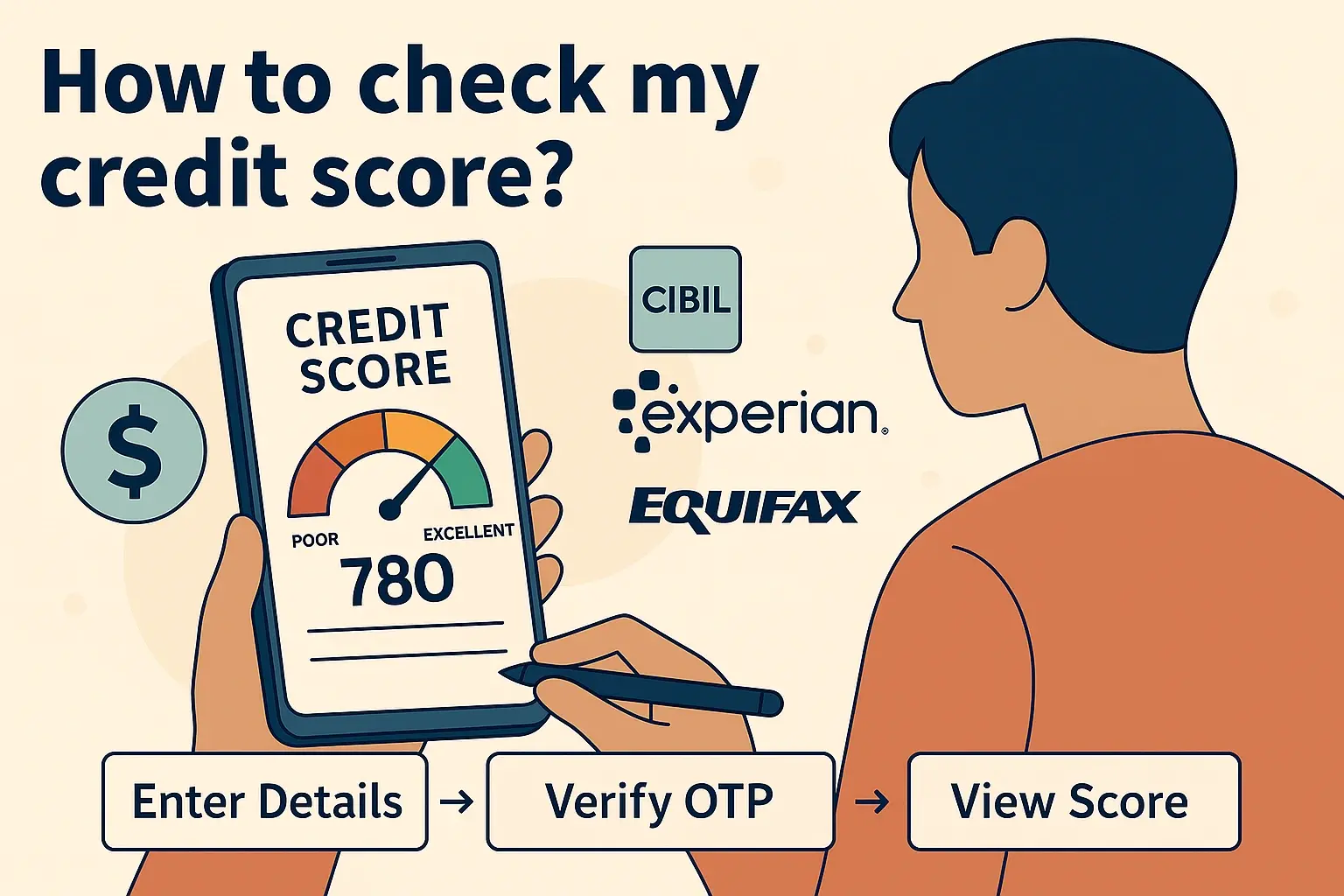

How Repossession of Your Car Affects Your Credit Rating If your car has been repossessed, this fact is also recorded with the three major credit reporting agencies: Experian, TransUnion, and Equifax. Repossession is one of the worst things that can happen to you, and it will bring your credit rating down. Most consumers experience a reduction of their credit scores to 100 points and below after their cars have been repossessed.

The extent of the effect on your score will depend on your overall credit profile or credit history. However, repossession is regarded as equally negative as filing for bankruptcy or foreclosure. If you do not take steps to rebuild your credit, it could take years before your credit score is not impacted by the repossession.

The Long-Term Impact on Credit Report Car repossessions remain on your credit report for seven years from their initial reporting date. It is very hard to get rid of it if you do not have evidence of some mistake made by the reporting agency. Even though repossession drops off your report after some time, your credit scores will still be affected for several years. Old credit scores are still used in newer FICO score computations.

One of the major effects of having a recent repossession on your credit report is that it becomes very hard to get approval for new credit. Anyone would agree with this, it is one of the things most lenders believe makes you a very high-risk borrower. For several years, you might end up getting higher interest rates, lower credit limits, or even instant rejection for credit applications.

Ways of Restoring Credit after Car Repossession Regaining a car after it has been repossessed requires effort and perseverance. However, if you begin repairing your credit early enough, you should be in a position to raise your scores in the shortest time possible. Steps to take include:

- Make sure to contact your creditors and see if you can reach an agreement over the pay-for-delete of the negative items when you can. This deletes unfavorable entries from your reports in exchange for paying off collection accounts.

- From now on, make sure that you promptly pay all of the current bills that you have. The payment history is a vital component of credit score calculation since it contributes to over one-third of the total value.

- Maintain high levels of credit utilization on credit cards. Another thing that high debt usage does to you is that it reduces your credit scores.

- Most people should refrain from applying for credit because it has been known to lead to the borrowing of money. This means that establishing too many new applications can reduce your score and depict risk.

- You can add positive information to your credit reports by getting and properly using secured cards, credit builder loans, or by reporting nontraditional credit information.

- Report to the credit bureaus should there be any information on your reports that is pulling down your scores.

- If the repossession has left you financially unstable, then try to find a credit counselor who will help you regain stability.

How Long Will It Take for Credit Rating to Recover After Repossession Most consumers are interested in knowing the period it takes for a repossession to cease affecting credit and scores. Sadly, there is no specific number here. It will hinge greatly on your initial performance, your general credit mix, and how much effort you are willing to submit in the process of reconstructing good credit.

You can expect a car repossession to negatively affect your credit rating for approximately 18-24 months initially. However, if, during that time, you cannot pay your bills, accrue more debts, or have other delinquencies, it will affect your credit for an even longer time.

To improve your credit score, you will have to spend time rebuilding a positive credit profile for at least 12-24 months. If, at present, you show a consistent streak of responsible credit behaviors, you may be able to fully restore your credit within five years from the repossession date. But this is not always the case and might be different from one situation to another.

Connect with a Credit Expert If you have poor credit as a result of auto repossession or any other reason, it is advisable to seek the services of a credit counselor or a credit specialist. They can come up with specific strategies for improving your credit based on your overall financial state. This is usually a lot more helpful than attempting another credit repair ‘fix it in a hurry’ product you may come across. Call a non-profit credit counseling agency in your region for help.

Despite this, through hard work and commitment, you can rebuild your credit after car repossession, even if you have bad credit. Repeating responsible behaviors will bolster your scores over time to help you secure credit again. Car repossessions exact long-term harm but are not beyond the capacity of being erased over time through reconstructing good credit balances.

Ready to boost your credit score? Call +1 888-804-0104 now for the best credit repair services near you! Our expert team is here to help you achieve financial freedom and improve your credit. Don't wait—get started today!