How Long Does A Missed Payment Affect Credit Score?

When it comes to loans, credit cards, or any other form of credit, missing a payment can and will significantly lower your credit score for the worse within the blink of an eye. Another factor that significantly influences credit decisions is the credit score, which is why it is crucial to know how missed payments impact credit scores.

How do Credit Scores work?

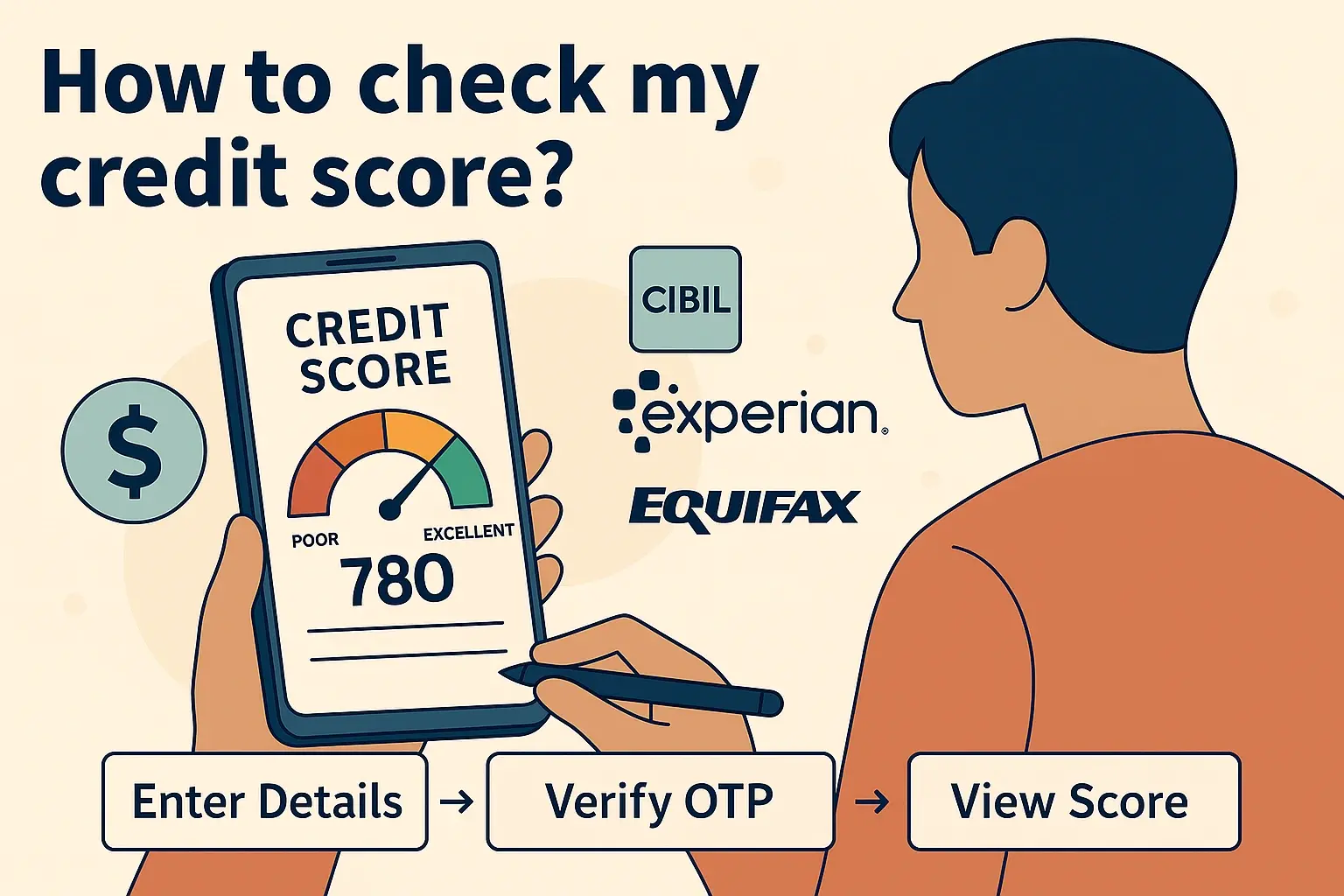

Among the credit reporting companies watching your payback record on all of your credit facilities are Experian, Equifax, and TransUnion. They compile this data into a credit report, which helps you to get your credit score. With a numerical range of 300 to 850, a higher score indicates better quality. Though several elements determine your score, credit use and payment history are two of the most important ones.

You discover that this is shown on your credit score when you fail to pay a specific amount of money when due and find it recorded to the credit bureau. A one-time faulty payment does not indicate that you are a poor payer, hence, it will not have much of an impact on you. However, if it is regular, the impact will be significant.

How Long Can A Missed Payment Affect Your Credit Score?

A missed payment drops your score substantially for approximately 12 months. It stays on your credit report as missed but is less damaging to your credit score over 7 years. Here is more detail:

- 0-30 Days Late Ideally, a payment is not marked as being late to the credit bureaus until it is about 30 days past due. A one-off 30-day late payment should not affect your score by more than 20 points if you have good credit.

- 30-60 Days Late In this stage, the missed payment will affect the credit report of the bureau, and the score could drop by about 60-80 points. The way your credit score behaves is that the more points of positive payment history you have, the less those points will negatively affect your score.

- 60-90 Days Late: If you have not paid for the last two months, then your account is considered seriously in arrears. This can reduce your credit score by as much as 90- 150 points. The later the payment, the worse it gets.

- 6 Months Late If you fail to pay your credit card for six months, it becomes very serious – your credit score may drop by 150-225 points. Another consideration is the proportion of the total credit that the unpaid account constitutes. The more the balance, the greater the loss.

- 12 Months Late In as much as credit scoring is concerned, your credit score will be most affected when a payment is missed for an entire year without it being reported as current. It is, therefore, advisable to expect your score to drop considerably – below very poor, which is equivalent to 600.

- This is also detrimental to your score because many lenders will charge off severely late accounts after 6 months. Charge-offs are kept for 7 years.

- 5-7 Years Late So even if you manage to settle a long overdue payment, it is still reported on your credit report for up to 7 years starting from the date of the initial missed payment. But each subsequent year reduces the impact somewhat until it gradually disappears from your report after one year.

How to Rebuild Your Credit After Being Late on a Payment?

One disadvantage is that late payments are costly, but they can be managed and rectified in the future through credit repair. If you were late on a payment, state that the account is current and then ensure that all subsequent payments are made on time. Also, it is important to maintain low credit utilization on all credit cards. For instance, if you had a very good credit standing before a 30 or 60-day late, it only takes a couple of months of positive payment history to begin reversing the effects of the ding.

You can also request your lenders to report your account as paid as agreed if you address the problems and maintain a clean record of payment for 6-12 months. Note that this is at their discretion, but it assists in eradicating the undesirable status shown to anyone who requests your credit report. If the credit history of the payment is good, it is possible to see an increase in score after several months.

Thus, the key message is that credit scores can be dramatically and persistently hurt by missed payments– but they will recover eventually. However, if you try hard enough to rectify this issue, your credit scores are bound to rise. The only thing that needs to be ensured is that those late payments were one-off incidents and not a repeatable pattern.

Ready to boost your credit score? Call +1 888-804-0104 now for the best credit repair services near you! Our expert team is here to help you achieve financial freedom and improve your credit. Don't wait—get started today!