How Many Points Does A Repo Drop Your Credit Score?

A repo or an automobile repossession can also affect your credit score a great deal, as it can reduce it by as much as 100 points or more. The exact drop will vary depending on your credit situation and credit history. In this article, you will learn about how repossessions impact your credit, how many points your score will be dropped, and ways to rebuild your credit after a repo.

What is a Repo, and How Does it Affect Your Credit Score? A repo, which is short for repossession, takes place when one fails to make payments for a car or any other item bought on an installment credit basis, and the creditor repossesses the item to recover his or her losses. It is fundamentally a compulsory surrender of the object being financed. The item is sold, and the cash generated is used to clear the rest of the balance from the loan.

Losing your car or any property that was used as collateral to secure the loan has a significant negative impact on your credit in two ways. First, it harms your payment record, which is one of the key factors affecting your credit score. Creditors consider you a bad credit risk if you are unable to repay amounts borrowed on time. A repo means that one is severely in the red, not just a couple of days behind on their payments. This has a negative implication on future potential creditors as it symbolizes high risk.

Also, repossessions trigger account charge-offs by the lenders. The remaining loan balance that is not covered by the proceeds from the sale of the repossessed item is often considered a charge-off and may go to collections. The charge-offs also negatively affect your credit standing and scores. They lead to a higher count of late or missed payments, as well as relatively high balances when compared to the original loan amounts. Either situation lowers your results.

How Low Could My Credit Score Go After a Repo? The actual impact of a repossession on your credit score depends on your initial credit score before this event occurred, as a general rule. However, FICO states that most people lose anywhere between 85-160 points on their scores should their car be repossessed. Some key determining aspects include.

- Prior credit history – The further apart the numbers, the greater the chance for higher scores, but the lower scores cannot decrease as much as others.

- Cause of the repo – Was it due to loss of job, illness, or some other factor beyond your control? Or was it because of extravagance and the misuse of your creditworthiness? Now, while creditors do sometimes write ‘mitigating circumstances’ on your credit reports if you talk to them, this isn’t the same thing as legal protection.

- Previous repurchase history or charges – If the repo follows a history of bad credit, then the score drops to a lesser value as compared to when it drops from a higher value.

Generally, here is an approximate breakdown of how many points your credit score could drop based on where your score started.

It could decline to as low as 150 to 170 and move to the “good” credit score range instead of the “excellent” credit score range (740 to 850).

Fair Credit Score Range (670 to 739) - Possible 90 to 110 point drop. Depending on how much of your credit limit you use and how long you have been establishing credit, it is possible to have a ‘fair’ credit rating.

Poor Credit Score Range (580 to 669) - Loss of approximately 60 to 80 points resulting in very poor credit rating.

Low Score Range (300 – 579) – May drop by only 40-60 points because the scores are low to begin with. But it could also fall over 100 points.

For how long will a repossession impact my scores? An auto repossession can affect credit scores for as long as seven years from the initial delinquency that culminates in the car repossessing. Most negative credit information, including reports, stays on your credit reports for seven years, starting from the first date of delinquency.

Although the most significant damage happens in the first year after the event, the dark mark remains, lowering your credit scores as long as it is on the list. The effect slowly dissipates over time, though, but its overall influence on society is unmistakable.

For instance, a 100-point hit to your scores after a repo may reduce to as low as a 60 hit after two years, provided you manage your credit well and meet all the obligations on time. However, for your score to fully recover from that repossession, it would only regain the lost ground when that repossession is washed off your credit history after seven years.

Measures that can be taken to Reconstruct Credit after Auto Repossession It is embarrassing and emotionally straining to have a vehicle repossessed. But the financial pressure and the credit score knock are the most devastating. Here are proactive steps you can take to start recovering your credit after surrendering your car.

- Settle the remaining loan balance owed - The lender should help in determining the amount of money that the borrower has to pay after the seized car has been sold. Then establish installment payments you can comfortably meet every month. Full repayment will not delete the incident from your credit reports before seven years but will help creditors understand that you have the intention of settling debts.

- Challenge unfavorable entries with the credit bureaus – Obtain copies of your credit reports and review the reports for any erroneous or outdated information connected with the repo. Some of the complications that may occur may include; whether it is making the repo several times across bureaus, showing up twice under one bureau, or the wrong delinquency date. If errors exist, file disputes and offer specifics to have incorrect information addressed or taken down, which may reduce some harm.

- Be an authorized user – This involves seeking help from a relative or friend with an old credit card, good payment history, and high credit score to make you an authorized user, hence reducing the bite of the new repossession. What they have to do is attach your positive history to your credit reports, which instantly increases your scores.

- New credit – Applying for new credit accounts establishes that one is still qualified for a credit account. Misusing credit cards or secured loans, such as letting balances go high or delaying payment, will give negative references on your credit reports to counter the repossession.

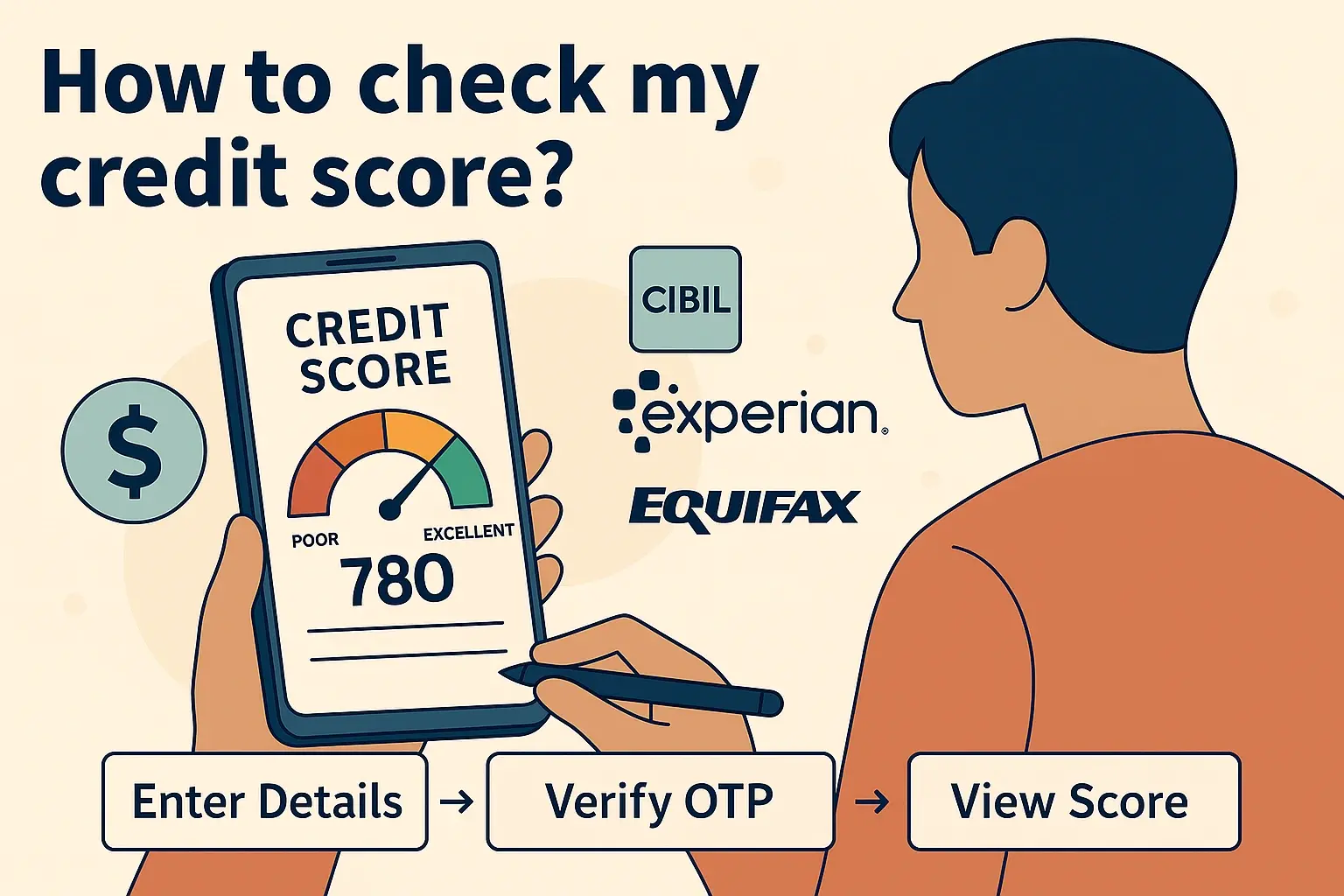

- Get registered for credit check – Credit check services give information on credit reports and scores from the three credit bureaus. They inform you of any large changes, new inquiries, or negative information added, which serves to protect against identity theft or fraudulent accounts arising from a repo. Monitoring also enables you to manage disagreements swiftly if there is wrong information concerning the repossession. Using monitoring sites to compare auto loan rates, mortgages, and other lending rates will not affect your score by contributing to the appearance of hard inquiries on the report.

The earlier you begin to undertake such credit recovery actions following car repossessions, the earlier you will note improvements in your scores. Maintaining credit responsibly going forward is also essential in rebuilding the credit created by the repossession ordeal. New positive lines of credit and on-time payments will, over time, offset the effects of the old default.

Ready to boost your credit score? Call +1 888-804-0104 now for the best credit repair services near you! Our expert team is here to help you achieve financial freedom and improve your credit. Don't wait—get started today!