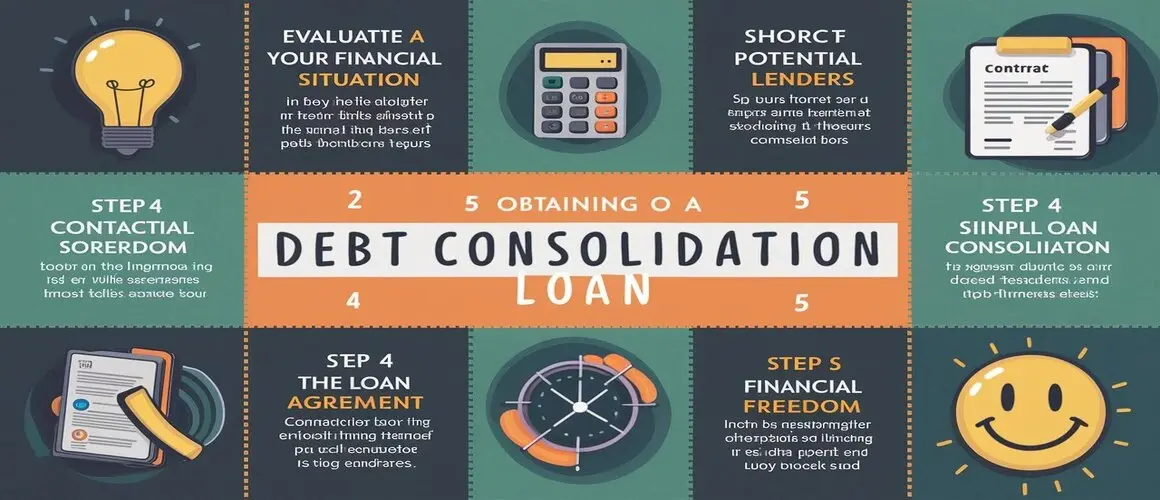

How To Get A Debt Consolidation Loan In 5 Steps ?

A debt consolidation loan lets you take out one larger loan that pays off several other debts and comes with one monthly payment. This can help make the handling of your debts a lot easier and less costly. If you have high-interest debts on multiple credit cards or loans, then it will be beneficial for you to take a debt consolidation loan so that your monthly payment and the time you take to pay off your debts are reduced. This article will provide the reader with a clear understanding of how to acquire a debt consolidation loan in five crucial steps.

Step 1: Divide Your Debts by the Number of Months

The first thing is to prepare a table that contains all the current debts with the interest rates, monthly payments, and balance payments. This covers credit card debts, personal loans, and medical expenses, among other unsecured debts that you want to combine. Secured debt, such as car loans or mortgages, should not be included. It would also be useful to sum up the total minimum monthly repayment to get an idea of how much one at present repays. Debt consolidation loan payment should, therefore, be lower than this sum.

Step 2: See your credit rating

The majority of lenders will always consider your credit score and report before approving your consolidation loan. By doing some background research on credit scores and reports, you get to know your likelihood of being approved for a loan. You are entitled to one free credit report from each of the three bureaus each year through AnnualCreditReport. While you will have to pay for your FICO credit scores, you can do so at myFICO. Com or another authorized source. Therefore, to get a debt consolidation loan with favorable interest rates, you should have a credit score of 620 or above. If your score is lower, it is better to work on credit score improvements before applying for a loan.

Step 3: Research Lenders

Debt consolidation loans can be provided by several lenders, such as banks, credit unions, online lenders, and debt management firms. Explore the choices and consider the anticipated interest rates, loan period, monthly payments, and costs. Some of them are the minimum credit score, maximum loan amount, and debt-to-income ratio. Take your time and type keywords that refer to your credit standing into the search engine. Non-credit-based filtering instruments can be very helpful in reducing the field of choices without performing a tough credit check.

Step 4: Apply for Your New Loan

After choosing the right lender and loan type, fill out the debt consolidation loan application. Expect to disclose your identity and history, income, debts, and assets, among other things. Be clear on all charges, and remember to read any contracts before you sign them. Lenders who request fees before approving your loan should be avoided. Most of the lenders have online applications, and this makes this process easy and comfortable.

Step 5: Utilize the Funds to Clear Debts

Once granted, your lender will disburse the new loan amount to your creditors to clear the balances as per your permission. Payoff orders should be used strategically. The first step should be to pay the least amount owed so that the number of monthly payments can be reduced quickly. Then, continue to pay the remaining money in high APR debts to get the most savings for the interest charges. It is also important to shut down the credit card accounts that have been paid off or to delete them. Do not run balances back up on paid-off accounts, or this would defeat the purpose of consolidating the accounts.

Benefits of Debt Consolidation

When done correctly, a debt consolidation loan can offer multiple benefits, a debt consolidation loan can offer multiple benefits including:

Reduced monthly installments through elongation of the term of repayment and reduction of the interest rate. Reduce repayment period with single loan amortization schedule A single fixed monthly bill instead of many different ones Support the organization and better management of finances Cut the interest costs based on the new loan rate More convenient to pay a single consistent amount to cater for the meals and save more when planning for the amount to set aside for meals. It may work to gradually boost a bad credit rating in the long run. Some of the lenders also provide extra services such as credit restoration.

However, it is important to note that the following step-by-step guide should be followed when getting a debt consolidation loan to get the right loan and manage the funds properly. Reducing the number of high-interest debts can be one smart decision one can make toward the journey of becoming debt-free.