What Is A Good Credit Score To Get A Loan?

Loan approval depends on the credit score and therefore, one has to ensure they maintain good credit scores.

A credit score is vital for loan application since lenders consider it an essential feature when approving loans because it determines the ability of the borrower to meet the debt obligation. Well, what kind of credit score or rating will be considered good enough to be granted a loan in the current world? Here, you will find out the credit scores that lenders prefer in deciding on loan applications for various forms of credit.

Knowledge of what each credit score ranges entail

Fico scores are on a scale of 300 and 850 though there are other means of measuring creditworthiness. The basic tool for evaluating the creditworthiness of borrowers is the credit score, the most widely used of which is the FICO score, created by the Fair, Isaac Corporation.

Here is a general breakdown of what the various FICO score ranges indicate to potential lenders:

- 800 and Above – Exceptional. FICO claims that those with scores in this bracket are almost sure to meet their credit or other obligations and thus they are less likely to default on payments.

- 630 to 699 – Good. A score in this range is considered very good and it helps the lenders in understanding that the borrower is eligible for most of the loans with good interest rates.

- 670 to 739 – Good. While most lenders deem borrowers with such score range as having valid loan requests with slightly higher interest rates than the very good credit score borrowers, but still reasonable.

- 580 to 669 – Fair. They are considered subpar by lenders since they do not meet their ideal standards when extending credit limits. However, they may yet approve but this may come with high fees as well as charges on the loan amount.

- Below 580 – Poor/Bad. Those individuals who have FICO scores below 580 that are categorized as bad credit will be struggling to get approved for loans or lines of credit. If they get approval at all, they will be able to lend at much higher interest to cover the risk of default to the lender.

A credit score is another factor that plays a key role in loan approval, and every lender has its regulations on credit scores for their clients, which depend on the level of risk they are ready to take in case of default. However, fair or above credit scores are not bad for availing the loan and those with a poor credit score probably have little to no chance of getting the loan.

A minimum credit score is the minimum FICO score required for customers to qualify for each particular type of loan.

Here is an overview of the typical minimum credit scores lenders look for with common consumer loan products:

Mortgage Loans Credit scores of most conventional mortgages are in the good to very good territory, and most lenders will not approve a mortgage loan with a below-average credit score.

Specific requirements vary by lender, but here are general guidelines:

- Conventional loans – A credit score of 620 is usually the minimum requirement, but having a score of 740 or higher is ideal for getting the most favorable rates.

- FHA loans – These loans have a low credit score requirement of 580, although some lenders prefer credit scores over 600.

- VA loans – Usually, a credit score of at least 620 is required.

- Jumbo mortgages – Originally, credit scores of 720 or higher are often required to qualify for a jumbo loan.

Auto Loans In general, for new auto financing, an acceptable credit score range is considered from good to very good.

Here are common auto loan credit score requirements:

- Prime auto lending – 6640/670, and it gets even better with interest rates going up to 720+/–

- Subprime auto loans – This is a loan in the credit score range of 550 to 640, more costly than the rate of prime loans.

A HELOC and Home Equity Loan

Home equity lines of credit and second mortgages are available for those who have good enough home equity and credit standings. Common requirements are:

- HELOCs – 620 to 640 is usually the minimum cases

- Home equity loans – minimum 640 and improved rates if they are over 700.

Personal Loans Unlike auto loans where one is restricted on what to do with the borrowed amount, personal loans can be used for any purpose. They have to have good credit for them to be approved.

Typical credit score requirements are:

- Online lenders – Starts from 600 and better at 640+

- Credit unions and banks – 640 to 660+ to secure the lowest rates

- Government payday loans – With a minimum credit score of 550

Credit Card Approval

Credit card issuers also have minimum score thresholds, including:

- The majority of the prime cards – 650 and above are preferred

- Secured cards – 500-600 – can be secured by a security deposit which helps to reduce risk.

- Retail cards – Again, the criteria may be different but are typically accompanied by no preset minimum.

How to Achieve an Excellent Credit Score

This means that as credit scores rise within any specific category, the loan terms and approval probabilities also improve.

If your score needs a boost, key ways to improve it include:

- Directly, individuals ought to ensure that all the bills are paid on time each month.

- Overspending is another cause of credit card debts; therefore, it is wise to maintain low balances.

- Do not apply for multiple credit cards and loan accounts

- The following steps involve ensuring that your credit report has no errors

- If you require some assistance with your credit, then credit counseling may be the solution for you.

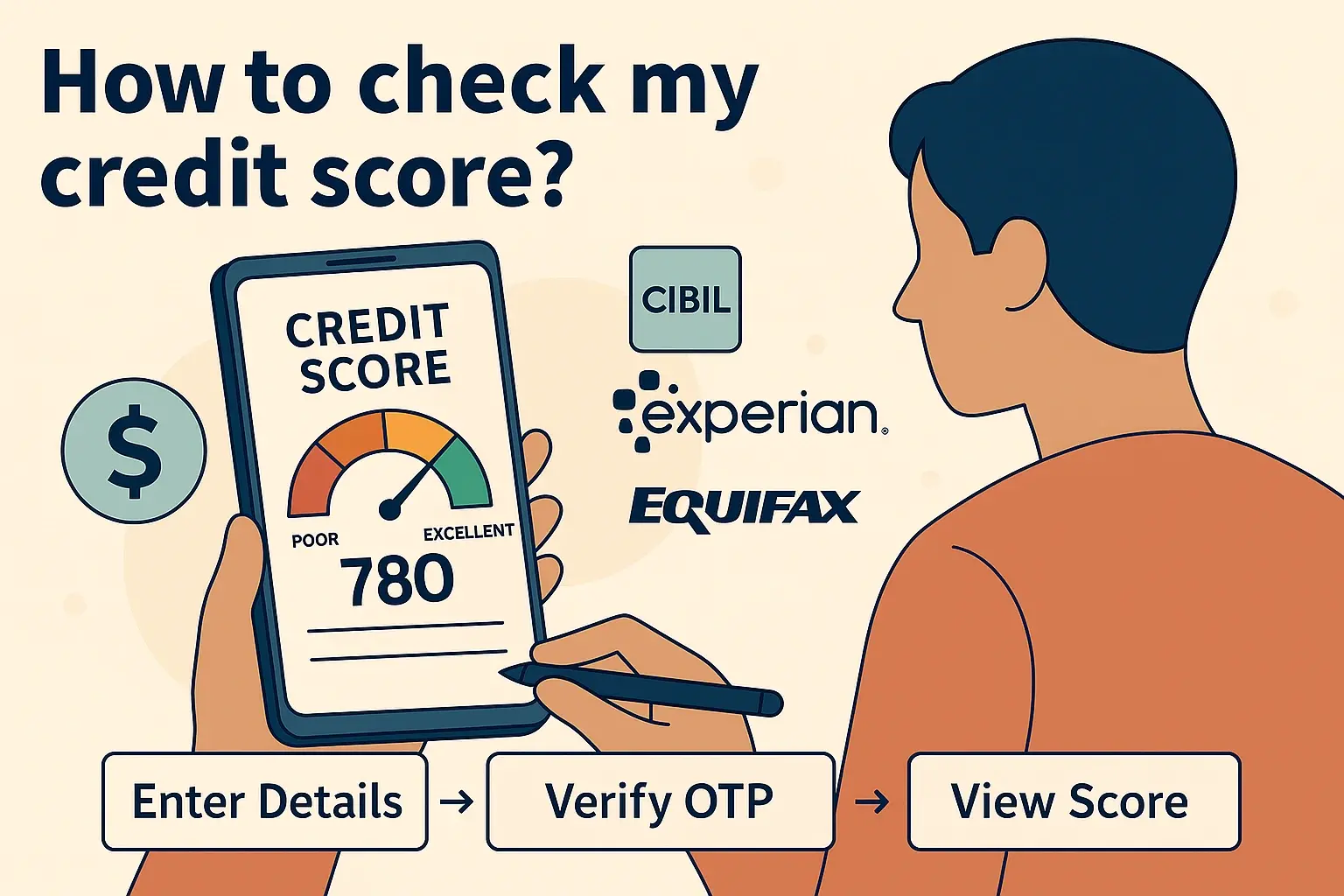

Comparing your current credit score with the latest one is easy and many free online resources give you an idea of where you are currently at. Before applying for a loan, it is time to check your score. Loans are likely to be approved, especially when accompanied by an excellent or a good job score, which comes with cheap rates. This merely means that even people with fairly average scores can find ways of meeting their borrowing needs through appropriate shopping.

Ready to boost your credit score? Call +1 888-804-0104 now for the best credit repair services near you! Our expert team is here to help you achieve financial freedom and improve your credit. Don't wait—get started today!