What Is A Hard Credit Inquiry And How Can It Affect Credit?

Hard Credit Inquiry: Definition And Impact On Credit

Every time you apply for any kind of credit or loan, the firm will check your credit report to see if you are qualified for the specific credit. We call these credit queries or credit pulls these checks of your credit. There are two main types of credit searches: soft and hard credit searches. Since one is known to influence your credit score and the other is not, these two are different kinds of credit searches.

What Does It Mean When Someone Has Made A ‘Hard Credit Inquiry’?

Usually undertaken by a credit provider after a credit or line of credit application, a hard credit check—also known as a hard credit pull—is often. Hard inquiries arise from credit cards, personal loans, auto loans, mortgages, or any other credit application. A hard inquiry indicates that you are actively seeking a loan or new credit.

By applying, you are effectively letting that lender review your credit record and assess your credit risk profile. As such, every time the lender requests your credit report, this is seen as a hard query on your credit. Although your scores may somewhat decrease from such checks, unless you have often asked for credit, this is not a significant reduction.

How Do Hard Inquiries Impact Your Credit Score?

Most hard inquiries can impact the credit scores of the individual by a few points, though this tends to be more common when there are a lot of inquiries within a short time. Applying for several credit accounts within a few months is considered more dangerous than just one or two, therefore, this will generally have a greatly negative effect on credit scores. Nonetheless, the effects of most hard inquiries are quite small. Generally, a single new hard inquiry usually leads to a credit score reduction of a few points only.

FICO says that a hard inquiry can reduce the score of a person with an otherwise perfect credit score by about 5 points or less. Consumers who start with fair or poor credit ratings will experience even more significant declines in their credit scores due to new hard inquiries. Nevertheless, the score change for a new account application is likely to remain below 10 points for those borrowers who are given credit. However, multiple hard inquiries within a short period have a greater effect because they begin to resemble credit risk behavior.

It is also crucial to know that though it is true that hard inquiries slightly pull down your scores temporarily, the new account you got approved for will also help you build credit over time if managed wisely. Over time, as the new account persists and remains active, it could surpass the scores that resulted from the hard inquiry. Establishing a positive credit history is likely to increase the scores more over time than having a few points dropped due to a hard inquiry or two.

How Long Do Hard Inquiries Remain on Your Credit Report?

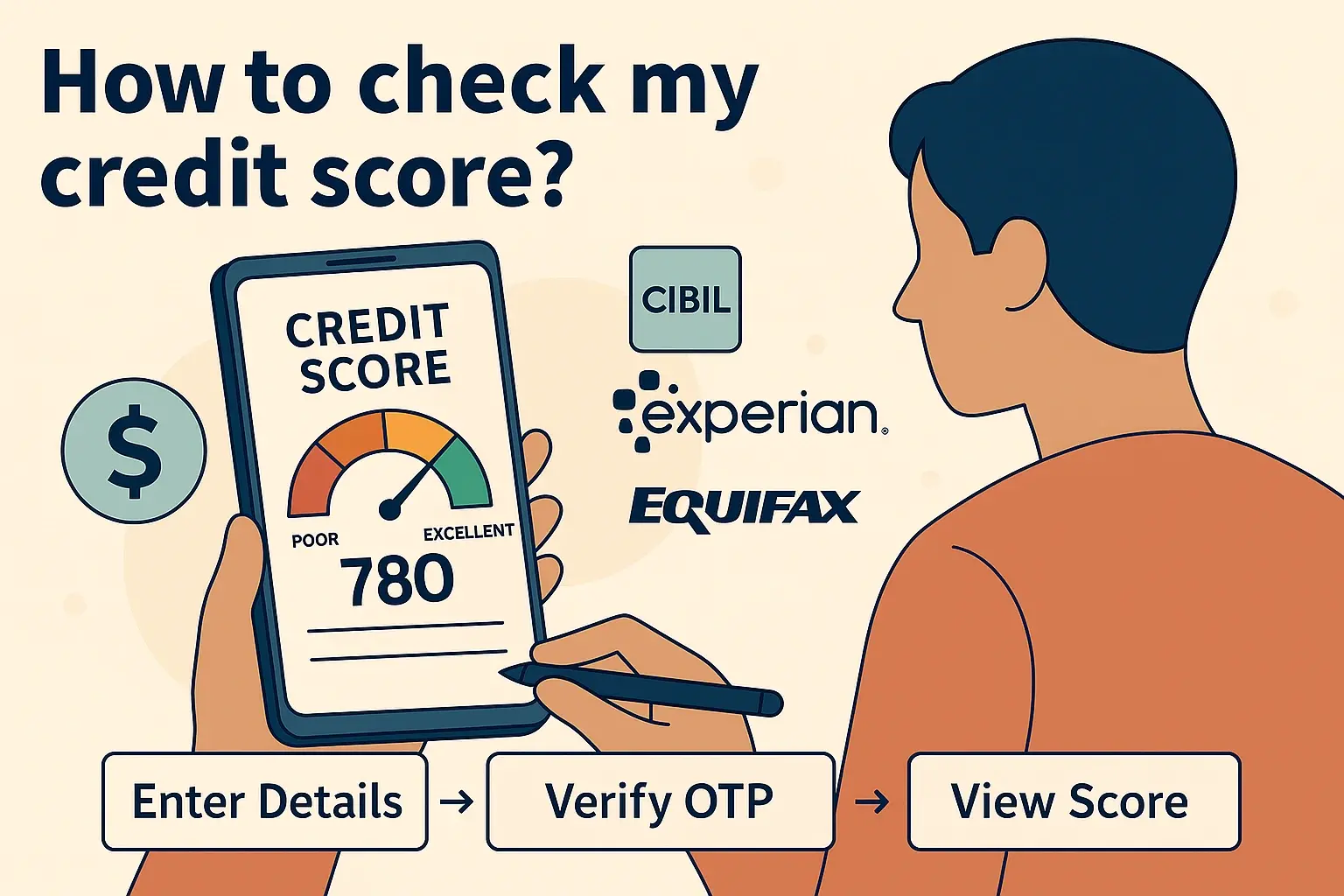

Every time a creditor asks for your credit reports, the transactions are recorded by the three credit bureaus, namely Experian, Equifax, and Trans Union. These hard inquiries, on the other hand, remain for 12 months in your credit reports, although their effect is maximized for the first six months before it slowly reduces. However, hard inquiries stay on credit reports for a full year and will continue to be incorporated into credit scoring a year after your application.

As hard inquiries stay on your reports for 12 months, so do their negative impacts, thus, it could be quite damaging in that period. A person with 10+ hard inquiries within the past year may face greater decreases in scores compared to a person with limited inquiries. Sending too many requests within those 12 months will give an impression that you are overly in need of credit or that you are likely to be wasteful.

How to Check for Hard Inquiries on Your Credit Reports

You should periodically review your credit records, as hard inquiries affect your credit and are shown to lenders evaluating you. At least once a year, it may also review all three credit reports to verify any additional activity on the report as well as the queries. The credit score system will not hurt you; your free yearly credit reports are available at www. AnnualCreditReport.com. All customers may see the Equifax, Experian, and TransUnion reports once a year to check the accuracy and the queries by utilizing this official website.

You may also examine inquiries by asking for a copy of your credit from many banks and lenders. For example, many credit card firms provide their customers with free access to credit scores and credit reports. Regular credit report check helps a borrower to be aware of all the lender queries as well as new accounts that show up in their credit history.

To sum up, hard credit inquiries occur whenever one requests a new credit or loan. These questions let the lender examine your credit record, but they might momentarily lower your credit scores for some period. Many challenging questions in a short time might reveal high-risk credit behavior and consequently affect the score more strongly. Although usually merely minor, it's important to keep track of the credit reports and understand the precise meaning of these questions. Although reviewing credit reports is free, it is advised that you do it every few months to see the latest scores and hard queries made in your name.

Ready to boost your credit score? Call +1 888-804-0104 now for the best credit repair services near you! Our expert team is here to help you achieve financial freedom and improve your credit. Don't wait—get started today!