What Is Bankruptcy? Benefits And Consequences For Your Finances

Bankruptcy is, therefore, a legal procedure for persons and firms who are unable to meet their obligations to creditors. Bankruptcy laws also vary in different categories, and the most common ones are Chapter 7 bankruptcy, Chapter 13 bankruptcy, and Chapter 11 bankruptcy. Bankruptcy means the extension of some of a person or business property to the creditors or else, the reorganization of the debts and coming up with a mechanism of how they can offset most of the debts.

What are the reasons that make people or companies go to court and seek the discharge of their debts? There are a few common reasons: loss of job, sudden bills such as medical bills, a business performing poorly, hence earning low revenue, and spending beyond income or profit, among others. When people or businesses are no longer able to afford to make even the most basic payments towards debts such as credit cards, medical bills, money owed to friends and relatives, etc, the debt starts accumulating, and bankruptcy may well start to look like the only way out.

Benefits of filing for bankruptcy

- Protection from creditor violence- Once a bankruptcy petition is made, there is a legal provision known as the automatic stay, which bars the creditor from increasing the pressure for repayment. This alone takes a very huge burden off the filers.

- Chapter 7 or Chapter 13 bankruptcy will discharge qualifying debts – credit cards, medical bills, personal loans, and others are wiped out after going through the bankruptcy procedure. This gives a new financial beginning.

- Exempt property - Under normal circumstances, people in bankruptcy cases are allowed to retain reasonable household effects, clothing, an automobile to an extent of value, retirement benefits, and primary residence in most instances. This goes a long way toward easing the hardship.

- Freeze creditor’s actions – wage garnishments, repossession of vehicles – A bankruptcy petition puts an instant stop to actions by creditors such as wage garnishment, repossessing vehicles, or foreclosure of homes, among others. This temporary relief assists the filers and attempts to get back on their feet financially.

- Develop a plan on how to make the payments – This type of bankruptcy, especially Chapter 13, allows the formulation of a schedule to make the payments within the period of between 3 and 5 years. Many of the remaining debts that are not cleared could be paid gradually without attracting additional interest or penalties.

Financial consequences of filing for bankruptcy

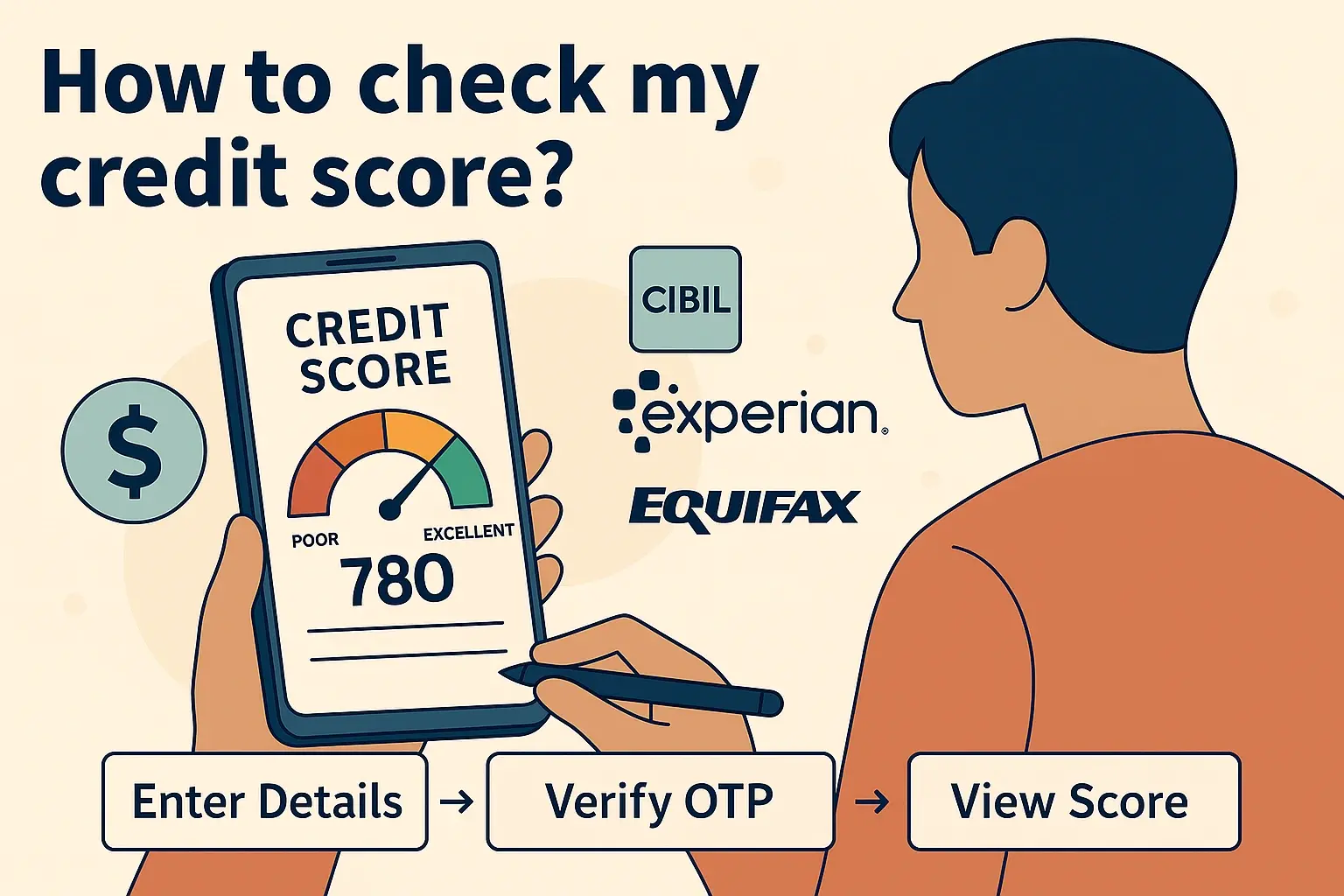

- Impact on credit history – For your information, a bankruptcy filing and discharge show up in the credit report of a person for up to 10 years from the date of filing. This hurts the credit score and the chances of accessing new credit products, thus the need to avoid it. It takes several years to reconstruct credit after bankruptcy.

- Some property or assets may be forfeited or sold – In some situations, it becomes necessary to forfeit some of the property and assets to clear some debts in bankruptcy. Personal bankruptcy filings usually permit the exclusion of simple essential property up to state-specific limits. Any assets worth more than these could be sold to meet these debts owed to creditors.

- Future wages can get garnished – While most unsecured debts, such as credit card debts, can be discharged through bankruptcy, certain types of debts like student loans, alimony, child support, and certain taxes cannot be discharged through bankruptcy. Wages can also be garnished to recover these unpaid amounts after bankruptcy and until they are paid as well.

- Bankruptcy is costly – While filing for bankruptcy, you need to pay some fees to the court and your attorney for the filing of necessary papers, consulting with an attorney about the process of bankruptcy, and attending meetings with the bankruptcy trustee and creditors, it could cost anywhere between a dollar to several thousand dollars. These have to be paid upfront, too.

- Prevents one from obtaining any credit facilities in the future, house, car, jobs, etc – Having a bankruptcy declaration affects the ability of an individual to secure credit in the future, including housing, car financing, credit cards, and even jobs. Another common decision makers’ prejudice that is also used by many landlords is excluding applicants with previous bankruptcies. It is common for employers to use credit information in screening, and bankruptcies may preclude applicants from certain financial and managerial jobs.

Thus, bankruptcy empowers individuals and businesses to have a clean slate in some ways by eradicating and restructuring unmanageable debts that they cannot pay. For this kind of debt relief and a fresh start, there are deep long-term costs such as credit report history, lost property, limited future loans, housing, wage garnished, and bankruptcy fees. Each of these considerations should be balanced for each case before opting for this major life-altering financial decision.

Ready to boost your credit score? Call +1 888-804-0104 now for the best credit repair services near you! Our expert team is here to help you achieve financial freedom and improve your credit. Don't wait—get started today!