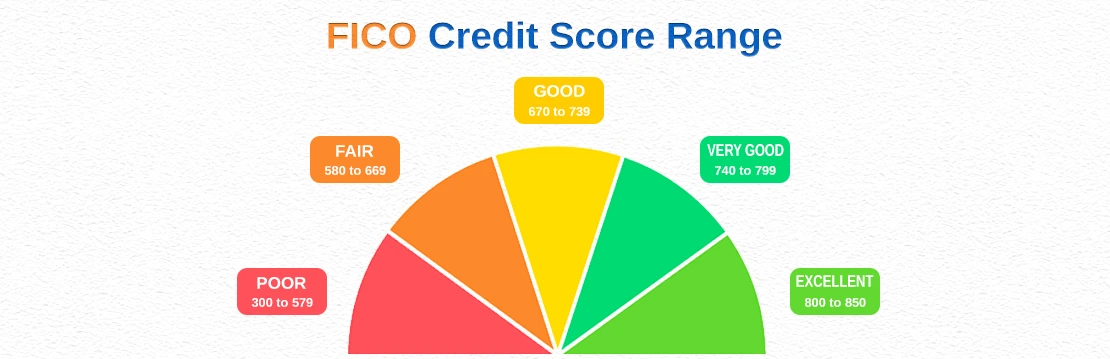

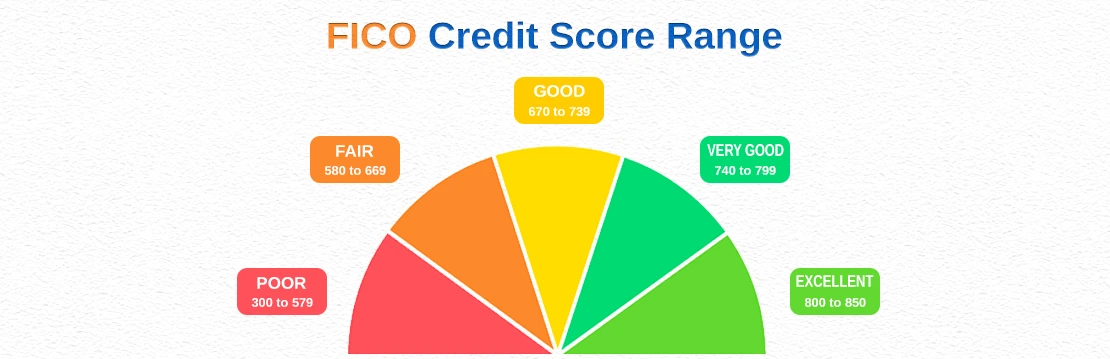

Credit score ranges

Ranges of credit scores provide creditworthiness an evaluation framework. A credit score usually ranges from 300 to 850. Poor scores range from 300 to 579, which suggests a high risk to lenders and sometimes means higher interest rates or trouble getting credit. Fair scores range from 580 to 669 and indicate both some danger and room for development. Good scores are those between 670 and 739, which suggest a reduced risk and often better lending conditions. Strong credit history and often better loan conditions are shown by very high scores, which range from 740 to 799. Best interest rates and credit chances are offered by excellent scores, which range from 800 to 850 and show outstanding credit management. Knowing these ranges enables people to assess the state of their credit and take action to raise their scores, which increases their financial prospects.

Credit score ranges typically range from 300-850. On average, a credit score in the low 700s has a 75% chance of being accepted.

- Poor: 300-580

- Fair: 580-669

- Good: 670-739

- Very good: 740-799

- Exceptional: 800-850

How to get your free credit scores?

Visit websites that provide free credit score services to get yours. Via AnnualCreditReport.com, major credit agencies such as TransUnion, Equifax, and Experian provide free credit reports once year. Your credit scores are also free to see on a lot of financial institutions, credit card firms, and personal finance websites. These sites don't charge anything, although you may have to register. Checking your credit score on a regular basis keeps you aware of your financial situation and points out any possible fraud or mistakes.

What is a good credit score and why does it matter?

Usually, a credit score between 670 to 739 is considered excellent. It represents trustworthy money management and less danger to lenders. Because it may result in better loan conditions, reduced interest rates, and higher acceptance chances for credit cards, mortgages, and other loans, a good credit score important. Because some companies check credit reports, a strong credit score may also affect insurance rates, rental applications, and even employment opportunities. A strong credit score reflects general financial health and prudence and over time guarantees greater financial prospects and savings.

What Is a Good Credit Score to Buy a House?

620 is usually considered an excellent credit score for home purchases. Although mortgages may be approved by certain lenders with scores as low as 580, your chances of getting a loan with good conditions increase with a score of 620 or higher. Greater scores—740 or higher, for example—can get you the best interest rates, which can save you money over the course of the loan. Credit scores are used by lenders to determine lending risk; a higher score translates into better loan alternatives and financial advantages when buying a house.

What Is a Good Credit Score to Buy a Car?

Generally speaking, a credit score of 661 or higher is required to purchase an automobile. Lenders classify this score range as "prime" because it entitles you to good lending conditions and interest rates. Even if you may get a vehicle loan with a worse score—600, for example—you could have to pay more in interest and have less favorable conditions. Securing the best financing offers may need a credit score of at least 720. When buying a car, keeping a strong credit score guarantees better loan alternatives and cost savings since lenders use it to assess your financial stability.

What Information Credit Scores Do Not Consider

Generally speaking, a credit score of 661 or higher is required to purchase an automobile. Lenders classify this score range as "prime" because it entitles you to good lending conditions and interest rates. Even if you may get a vehicle loan with a worse score—600, for example—you could have to pay more in interest and have less favorable conditions. Securing the best financing offers may need a credit score of at least 720. When buying a car, keeping a strong credit score guarantees better loan alternatives and cost savings since lenders use it to assess your financial stability.

What Information Credit Scores Do Not Consider

- Income: Your credit score is calculated independently of your salary, earnings, or other sources of income.

- Employment History: Your credit score is unaffected by your job stability or duration of employment.

- Age is unrelated to credit score.

- Marital Status: Your credit score is unaffected by your marital status—married, divorced, or widowed.

- Location: Your credit score is unaffected by the places you now or have lived.

- Interest Rates: Your present loans' or credit cards' interest rates are not taken into account.

- Child Support Oweds: This does not cover any payments you owe for child support.

- Money in your investment portfolios or savings accounts does not affect your credit score.

- Utilities and Rent Payments: Generally speaking, credit bureaus do not record regular utility and rent payments, hence they are excluded.

- Personal Information: Your credit score is not calculated using your gender, country of origin, race, or religion.

How does Credit Credit Repair in My Area get your score?

Credit Repair in my area helps improve your credit score by identifying and disputing inaccuracies on your credit report. They analyze your credit history, challenge errors with credit bureaus, and negotiate with creditors to remove negative items. By correcting these mistakes, they can improve your credit profile and raise your score. These companies also provide personalized advice to manage debt and build a positive credit history. Utilizing their expertise streamlines the process and makes achieving a better credit score more efficient than trying to do it alone.